Getting an educatonal loan to aid Purchase College or university

In this article:

- The way to get a federal Student loan

- Ways to get a private Education loan

- Other ways to cover School

- Build Credit to own Coming Borrowing from the bank Need

Regarding capital your college education, borrowing from the bank cash is among the many least enticing choices. But for of a lot college students, it’s inescapable. Depending on the Federal Cardio to have Degree Analytics, 46% of your own Group of 2018 browsing personal colleges was in fact given student financing, which have a higher rate out-of borrowing from the bank on individual nonprofit (59%) and personal to own-profit (65%) institutions.

On the majority regarding students who need so you can obtain, taking a student-based loan from national is virtually usually the leader. In case you are a graduate pupil otherwise a daddy trying assist your child get through university, you may be thinking about individual college loans.

Ways to get a national Education loan

Federal student loans are given while the school funding through your school. Since they are funded by the U.S. Company of Degree, government loans include certain professionals you will not get that have personal figuratively speaking.

Complete with the means to access student loan forgiveness applications and you can income-driven cost arrangements, and large deferment and you may forbearance solutions.

The process of bringing a federal education loan is relatively effortless. Possible begin by filling in the fresh new Free Application getting Federal Student Assistance (FAFSA). Using this type of, you can share monetary factual statements about your self and your nearest and dearest to assist the school’s financial aid office decide how far help qualify to possess in the way of student loans, scholarships, offers and you will performs-study applications.

Extremely federal student education loans do not require a easy 100 dollar loan credit score assessment, to also fill in the newest FAFSA with bad credit if any credit score. Only Lead Also Financing, which are open to scholar and you may professional children and you can parents, want a credit assessment. Even then, government entities will only discover really certain negative issues.

Student youngsters having economic you would like will get be eligible for paid figuratively speaking, which means that the federal government will pay the fresh new accruing interest while you’re in school, within the half a dozen-times elegance period when you get off university and you will throughout deferment attacks.

All other borrowers becomes the means to access unsubsidized funds, where you are accountable for all the interest one to accrues on membership. Student youngsters might also score unsubsidized funds if they you should never meet requirements to own backed finance otherwise keeps maxed the actual number they can borrow.

For those who be eligible for government student education loans, the latest terms-including the interest, mortgage payment and you can fees months-is actually standardized, and thus anyone which qualifies to have a particular sort of government mortgage has the exact same terms and conditions. Including, paid and unsubsidized federal financing awarded to help you undergraduates away from , keeps a fixed rate of interest off 2.75%.

How to get a private Education loan

Personal student education loans are less tempting than government finance since the they don’t have mortgage forgiveness programs, usually carry highest interest levels and rarely have the advantageous asset of income-determined installment preparations.

But if you maxed out your government mortgage restrictions-there are annual and you can aggregate limits-otherwise you’re a scholar college student otherwise father or mother, they’re worthwhile considering (specifically if you possess great borrowing).

Selecting a personal education loan concerns implementing with personal individual loan providers. Every one possesses its own standards having determining qualification and also have a unique set of interest levels, cost words or other enjoys.

Among cons out-of personal student education loans in place of federal money would be the fact private fund generally wanted a credit check. If you have sophisticated credit and a somewhat highest money (or a good cosigner that have one another), it more than likely are not a challenge, and you can even be capable be eligible for a lower life expectancy interest than what the us government even offers towards the scholar and you may parent fund.

But if your credit rating is limited or has some negative marks and you don’t possess an effective creditworthy cosigner, you have difficulties delivering accepted.

Thank goodness one personal education loan enterprises generally speaking allow you to get preapproved before you complete a proper application. This step needs simply a silky credit assessment, which won’t impression your credit rating, also it makes you find out if your be considered and you may compare speed offers to allow you to get the best deal.

When you’re eligible, brand new regards to your loan are different according to the borrowing from the bank history, money or any other products.

Alternative methods to cover College or university

If you find yourself student loans would be a convenient way to make it easier to cope with school, cutting how much cash your use produces a big difference for debt safeguards subsequently. Here are a few other ways you could potentially pay money for college or university you to don’t require one to afford the cash return from the a later day.

- Scholarships: Check your school’s website to see whether it’s got scholarships to own informative, sports or other grounds, so if you’re eligible. Along with, look for scholarships on websites such as for instance Scholarships and Fastweb. Possible filter out scores of possibilities to get a hold of of those designed for your.

- Grants: The main financial aid process is sold with has for students just who have the financial you want, thus completing your FAFSA is definitely a good idea, even if you you should never intend to borrow money. And, consult your school and you will discuss individual scholarship other sites to research other provides. Some gives may only be around so you’re able to pupils involved with particular college apps, or even in specific areas of research, this might be helpful to query a teacher or educational advisor you think will be educated.

- Part-time performs: In case the group schedule allows it, check for to your-university or of-campus operate to purchase tuition, fees or other academic and you will cost of living. Even if you merely functions a handful of era per week, your earnings accumulates throughout the years that assist you avoid several thousand dollars in debt during the period of your college occupation. Debt aid plan s to suit your university, which can make the entire process of in search of employment easier.

You’ll want to understand that selecting a quicker costly school and seeking with other a means to keep the will cost you down while you are when you look at the school may go a long way inside working for you lower your reliance upon college loans.

Build Credit having Upcoming Borrowing Requires

If you believe you’ll need to explore personal student loans during the one point in the future, or you only want to establish a credit rating for whenever you really need it just after graduation, the earlier you begin, the higher.

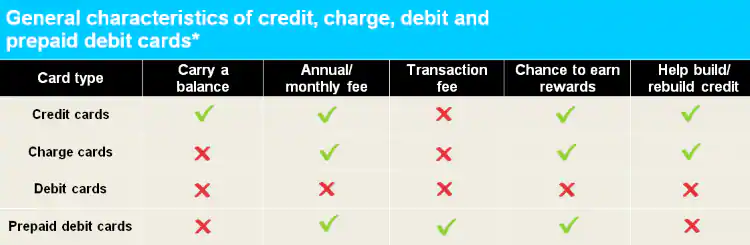

When you’re student loans can help with you to, they will not do far unless you start making repayments, hence won’t occurs for the majority of until just after graduation. College student credit cards are a terrific way to generate credit due to the fact so long as you keep equilibrium reduced and you will pay their expenses timely plus in full every month, you can prevent appeal charges.

Even though you work to create credit, display screen your credit rating frequently to keep track of how you’re progressing, and you may address any possible facts as they occur.

Напишете коментар

Мора да се пријавите за да испратите коментар.