Simple tips to finance a cabin otherwise second house

Trick insights:

- It’s wanted to be eligible for a conventional financial to finance a good second home otherwise cabin.

- With the reduced rates and greatest income tax breaks, it could be far better end taking right out property equity loan to spend the new advance payment otherwise closing costs on your next family.

- To end spending landlord fees in your second assets, dont lease it for over 2 weeks for every single 12 months.

Whether you are purchasing a secondary house within the a hotter weather or to get a great cabin towards lake for the Minnesota otherwise western Wisconsin, it is possible to follow the same easy steps when it comes to financing an extra family. Listed below are five ideas to recall when buying a beneficial next property.

step one. Budgeting to own a moment house

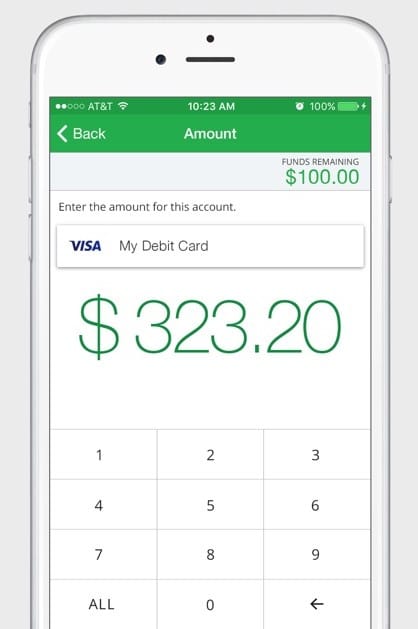

Even though it can be exciting to get the 2nd assets you have always wanted, step one in the process of taking the next home loan is a little shorter enjoyable – budgeting. Your residence home loan representative makes it possible to plan out your finances because of the evaluating your own:

- Limitation mortgage repayment

- Yearly homeowner’s insurance coverage

- Income tax costs

This data, named pre-recognition, is the greatest way to get reassurance concerning your to buy stamina – and is particularly of use if you find yourself to find the next possessions.

dos. Information traditional loan requirements

Government Property Government financing, or FHA loans, are merely readily available for number one houses. So, if you’d like resource when buying a secondary family, you will likely have to apply for a conventional loan. To put your best ft give when taking away a conventional mortgage to your the next family, it is suggested placing 20 so you can thirty-five per cent off within closing.

Remember that capital the next family is generally a larger exposure getting loan providers, which could be harder to help you be eligible for a vacation house loan than simply it actually was for your top home. Possibly the most qualified buyers tends to be provided a somewhat high interest rate on their second family, in an effort to include the lending company against that risk. To move the process along effectively, are still diligent and supply their bank that have any paperwork it demand.

step 3. Taking out fully property equity financing

The home loan consultant can help you determine if we want to use your top home’s collateral to simply help purchase the fresh closing will set you back otherwise advance payment in your next house. There was a capture to that arrangement: If you take out a home equity personal line of credit when taking a secondary real estate loan, you may want to get a top interest.

When you take away property collateral financing into the next property, additionally, you will be interested in possible taxation ramifications. Dependent on your debts, you may not have the ability to subtract any mortgage attention from your taxes once you add in one minute household. Seek out an income tax representative to own suggestions if you have questions regarding your taxes whenever taking a moment mortgage.

4. Choosing your own leasing strategy

Before you buy a second home or lake cabin, you have to know if you intend to help you lease the house aside, and how tend to. Some loan providers try hesitant to financing local rental land, while others may increase the home loan rate to the a rental possessions. Should you want to lease your next home shortly after to buy they, anticipate to put on display your bank evidence your capable build income off one assets. And additionally, know that the financial institution get imagine merely an element of the estimated leasing income whenever offering you the borrowed funds plus desire price.

Consider the income tax implications from an extra domestic that is used mainly once the a rental. If you book the house for less than two weeks each 12 months, you don’t need so you can report one local rental income towards the Irs even if the local rental draws in several thousand dollars when it comes to those 14 days.

However, for those who book your house for over 14 days an effective year loans South Vinemont AL, you’re going to have to report most of the rental income. Local rental programs like Airbnb and you can VRBO makes it possible to keep track of the leasing earnings, but you will still have to remain patient details away from personal have fun with versus leasing fool around with so you’re able to rightly deduct expenses like resources, insurance fees and more in the tax day.

Past, based your local area, you may have to spend state otherwise local taxes for the an effective assets your book when it comes to period of time – and you can also have to register your property because the a good local rental with your town. Having let staying above board with your property, get in touch with your own urban area authorities having details about getting a beneficial rental permit.

Moving on which have an additional household otherwise cabin search

The market to own river land and cabins try reddish-sexy and it’s vital that you work at a group who knows how to keep your monetary standing as you get your domestic on the run. Contact Edina Realty otherwise the representative to own advice about the second home get.

Напишете коментар

Мора да се пријавите за да испратите коментар.